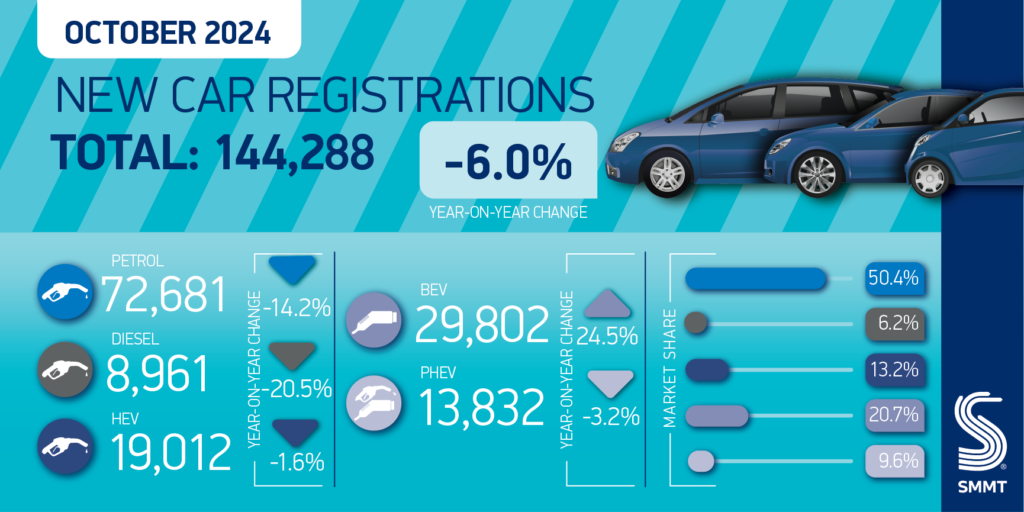

October marked another month of decline for the UK new car market, signalling a shift after two years of steady growth. According to the latest figures, total registrations for the month fell by 6.0% year-on-year, landing at 144,288 units. Both private and fleet sales struggled, with private purchases dropping by 11.8% and fleet registrations by 1.7%.

In Wales, the decline mirrored the national trend, with registrations down 3.75% to 5,165 units. However, the Kia Sportage continued to dominate, topping both the Welsh and UK leaderboards. The enduring popularity of models like the Sportage, Ford Puma, and Mini Cooper reflects the public’s preference for trusted brands even amidst market fluctuations.

BEVs Steal the Spotlight

One of October’s standout developments was the continued rise of battery electric vehicles (BEVs), which grew by 24.5% to 29,802 units. This surge gave BEVs a market share of 20.7%, meaning one in five new cars sold was fully electric. The widening range of BEV options, which now exceed 125 models, and enticing discounts have significantly influenced this trend. Notably, around 20% of BEV models are now available at prices comparable to or lower than traditional petrol or diesel cars, especially for buyers leveraging schemes like salary sacrifice.

October’s success builds on September’s record-breaking BEV performance, highlighting a shift in consumer sentiment and a push towards sustainability. However, industry experts caution that further investment in charging infrastructure is essential to sustain this momentum. Chancellor’s recent Autumn Budget, which maintains incentives for EVs in company car tax, was a welcomed step, but it’s only part of the equation needed to bolster consumer confidence in EVs.

ICE and Hybrid Sales Stumble

In contrast to the BEV boom, internal combustion engine (ICE) vehicles faced steep declines. Diesel sales plunged by 20.5%, with petrol also seeing a significant 14.2% drop. Hybrid Electric Vehicles (HEVs) and Plug-in Hybrids (PHEVs) were not spared either, experiencing contractions of 1.6% and 3.2%, respectively.

While the market’s contraction is concerning, the BEV sector’s resilience and growth hint at where the future might be heading. It’s clear that while many buyers still weigh up cost and infrastructure when considering electric options, there’s a shift towards acceptance and adoption of greener technologies.

October’s Top Performers

Despite the decline, a few models have continued to capture the market’s attention. The UK’s top ten included popular models like the Ford Puma, Mini Cooper, and Volvo XC40. Meanwhile, in Wales, the list was slightly different, with the Peugeot 3008 and VW Polo making the cut. Interestingly, traditional favourites like the Toyota Yaris and Nissan Qashqai held their ground, showing that the appetite for reliable, well-known models remains strong.

Light Commercial Vehicle Uptick

It wasn’t all downturns in October. Light commercial vehicles saw a modest increase of 2.4%, with 26,974 new vans, pickups, and 4x4s joining UK roads. However, even here, electric struggled, with a 1.9% drop in sales for pure battery models. This sector could face further challenges next year when new tax regulations for pickups come into play, treating them as cars, potentially impacting sales.

Looking Forward

As we approach the year’s end, the UK car market faces a balancing act. While BEVs are driving a positive change, the overall market’s volatility highlights the need for strategic investment, particularly in charging infrastructure. The government’s current incentives for EVs are a step in the right direction, but the road to sustainable growth will require concerted efforts across the board.